Filing your taxes can sometimes feel like deciphering a complex code, but it doesn't have to be that way. Numerous resources are available to help you Understand the intricate world of tax laws and ensure you're Complying with all regulations. Start by Familiarizing yourself with the latest tax Regulations. You can Utilize online resources, Obtain professional advice from a certified public accountant (CPA), or attend Classes offered by reputable organizations.

Employing these tools will empower you to File your taxes with confidence and Lower the chances of costly mistakes.

Understanding Your Tax Obligations

Every person has a responsibility to comply with their tax {obligations|. Failure to do so can result in fines. To confirm you're satisfying your {requirements|, it's crucial to understand the tax regulations that apply you. This includes awareness of income {taxation|{ deductions, credits, and filing {procedures|.

It's strongly recommended to speak with a certified tax expert. They can offer personalized guidance based on your individual {circumstances|.

Tips to Maximize Your Tax Savings

When it comes to reducing your tax obligation, there are a variety of check here proven strategies you can implement. A key stage is to undertake a detailed review of your monetary situation. This will help you identify potential deductions that you may be qualified for. By leveraging these tax advantages, you can materially reduce your overall tax liability.

- Explore setting up a retirement plan. These plans often offer tax-deferred growth, meaning you won't owe taxes on your earnings until disbursement.

- Make full advantage of the default deduction or itemize your deductible expenses, whichever is higher beneficial for your position.

- Stay informed about modifications in tax laws. Tax regulations are frequently evolving, so it's important to speak with a qualified tax professional to ensure you're compliant.

Common Tax Deductions and Credits

When it comes to filing your taxes, grasping common deductions and credits can remarkably reduce your tax liability. A variety of deductions are available for outlays related to your career, schooling, healthcare, and even charitable gifts. Additionally, tax credits can immediately reduce the amount of taxes you owe, dollar for dollar. Exploring these potential deductions and credits meticulously can yield significant fiscal advantages.

- Delve into itemized deductions for expenses like mortgage interest, state and local taxes, and charitable contributions.

- Evaluate eligible education credits for tuition, fees, and other educational expenses.

- Look into the child tax credit, which can provide a substantial lowering in your tax bill if you have kids under a certain age.

Submit Your Taxes: A Step-by-Step Guide

Navigating the world of taxes can seem daunting, but it doesn't have to be. Whether you're a student, understanding the basics of filing your taxes is crucial. This comprehensive guide will walk you through the process, ensuring you can navigate tax season with assurance.

First and foremost, assemble all necessary information. This includes your TIN, W-2 forms from your business, and any other relevant statements.

- Opt for the right filing method for your needs. You can file online, by post, or with the assistance of a tax expert.

- Employ available resources such as IRS publications, online tutorials, and programs to simplify the process.

- Double-check all information for accuracy before filing your return.

Duty on Firms

Taxes play a crucial role in shaping the landscape of businesses. They significantly influence various aspects of operations, from profitability to investment. A complex tax system can hamper growth, while a balanced approach can stimulate economic development. Business Owners must carefully consider the legislation to maximize their chances of profitability.

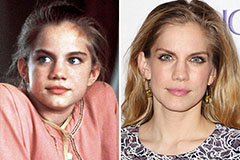

Luke Perry Then & Now!

Luke Perry Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Batista Then & Now!

Batista Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now!